iowa capital gains tax exclusion

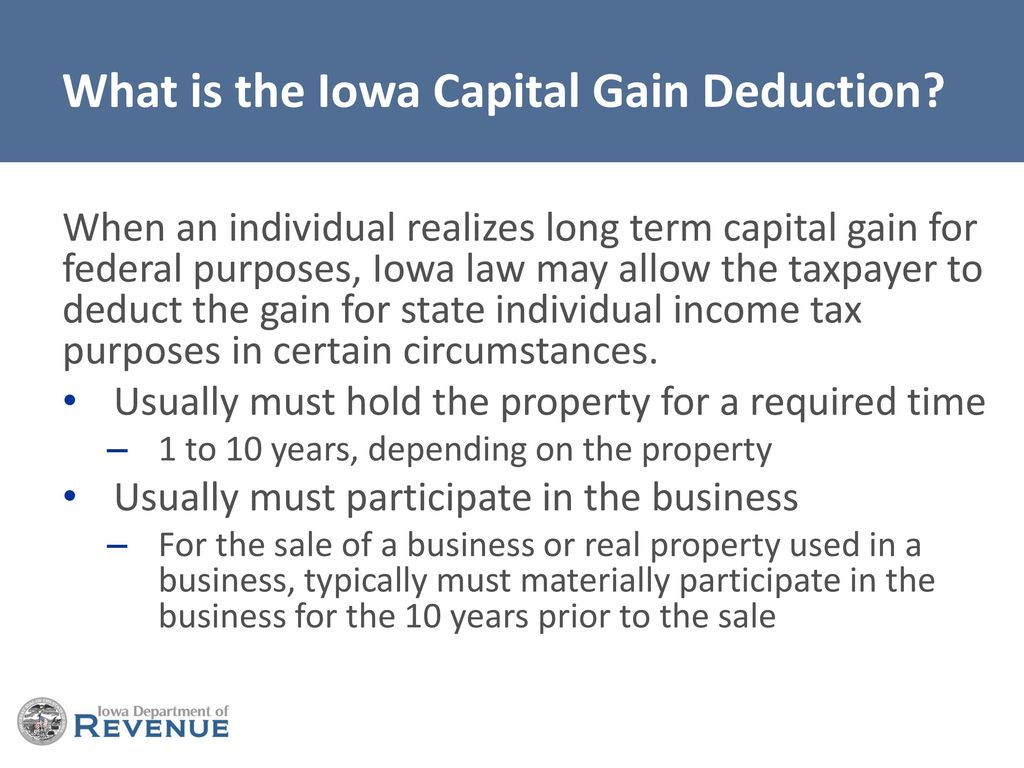

The most basic of the qualifying elements for the deduction requires the ability to count to 10 or. Iowa has a unique state tax break for a limited set of capital gains.

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

The law modifies the capital gain deduction.

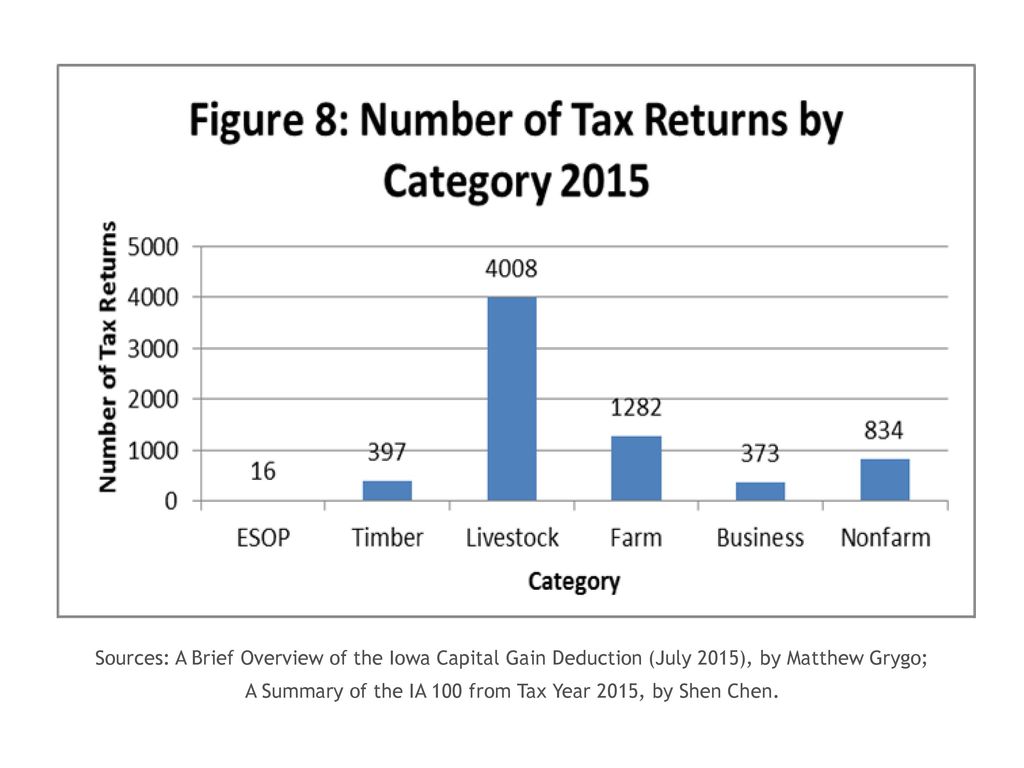

. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to pay will generally be lower as the state. This provision applies to tax years beginning on or after January 1 2023. Introduction to Capital Gain Flowcharts.

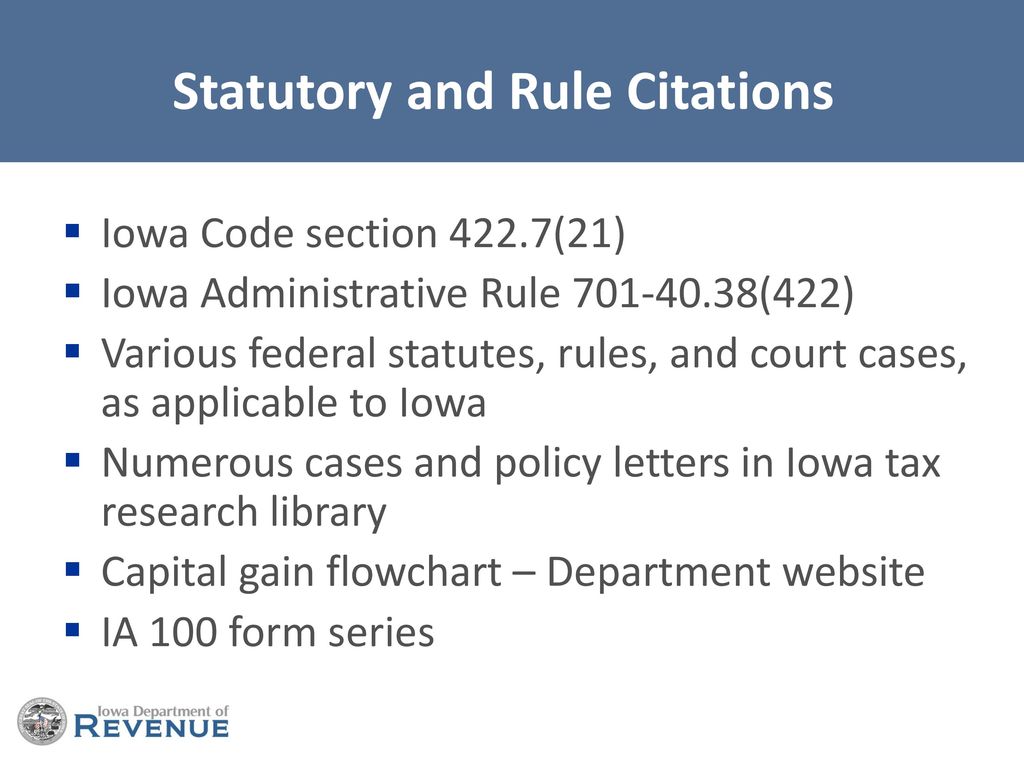

For the sale of business property to be eligible the taxpayer. The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. The document has moved here. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction.

The deduction must be reported on one of six forms by completing the applicable Capital Gain. The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception.

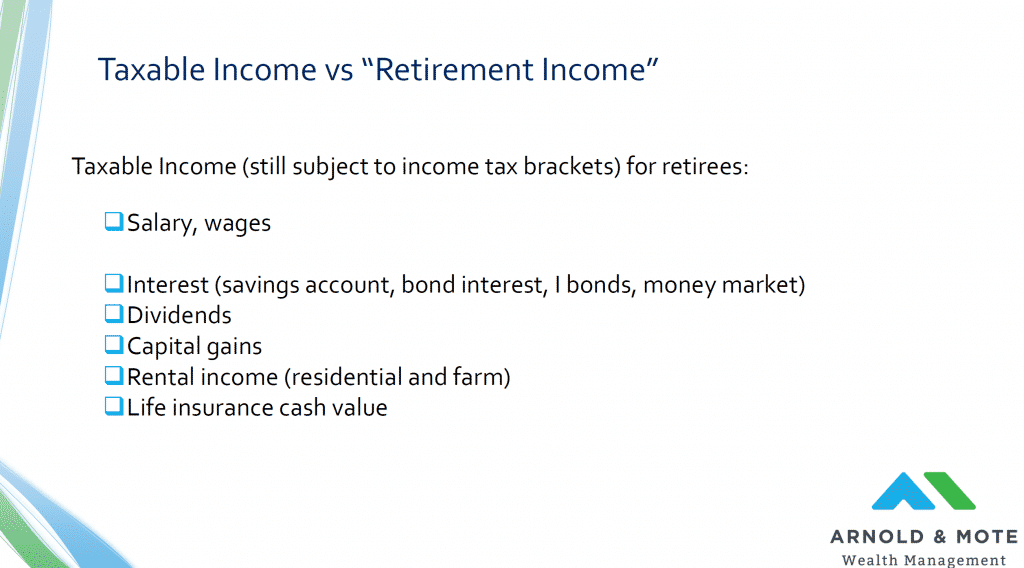

Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the. Retirement income taxes will be one. The Iowa capital gain deduction is subject to review by the Iowa Department of.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income.

How are capital gains taxed in Iowa. Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10 years but have retired from farming operations can elect an exemption of income from either cash rent. See Tax Case Study.

Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

When a landowner dies the basis is automatically reset. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Kim Reynolds signed last week.

Retired farmers will have several new tax exemptions to choose from under Iowas new tax law which Gov. Effective with tax year 2012 50 of the gain from the saleexchange of employer. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction.

Iowa is a somewhat different story. Division III Retired Farmer Capital Gain Exclusion.

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

Mechanics Of The 0 Long Term Capital Gains Rate

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

Revocation Of Capital Gains Tax Exemption Would Be Ruinous Canadian Real Estate Wealth

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

1031 Exchange Iowa Capital Gains Tax Rate 2022

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

What Are Capital Gains Tax On Home Sale In Dallas

How To Pay 0 Capital Gains Taxes With A Six Figure Income

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Estimated Tax Penalties For Home Resales

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Iowa Capital Gain Deduction Ia 100 Form Series Ppt Download

Hundreds Turn Out At Iowa Rally Supporting Credit Union Tax Exemption Credit Union Journal American Banker

Will You Have To Pay Capital Gains Taxes On The Sale Of Your Home Charles Schwab

Iowa S New Tax Structure In 2022 And Beyond

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool